GST Opinion Services

Khandhar Mehta and Shah | GST Opinion Services

Introduction

Goods and service tax is a very significant taxation scheme, which has absorbed most of the indirect tax like service tax, vat, excise, etc.

It brought changes in the tax structure, tax computation, compliance, tax payment, tax incidence, and reporting. Moreover, it affected the operations of businesses, business models, implementation of policies, and key compliances. We provide you the GST opinion services and advisory services where you get the definite solution for your GST related concerns.

It has been very difficult for businesses to adopt the new indirect tax and get all the compliances and tax liability payments done effectively and efficiently. We, at KMS, express our expert opinion on matters related to GST to ensure that you comply with all the GST related statutory requirements.

We provide:

Opinion on the impact of GST on cost, availability of credit, pricing and working capital, and revenue and procurement stream;

Advisory services on anti-profiteering provisions of GST, appropriate precautions to be taken, and pricing mechanism considering the legalities involved and additional savings;

Consultative services on alternative business models for credit optimization and tax efficiency, potential risks, and mitigating strategies, and contractual scenarios that can work for companies;

Review services for reconciliations, records, and formats, audit reports, filing of annual audited accounts, notices or communication from the tax department, and specific, incidental, and ancillary records as required by GST law

Being one of the well established CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

GST Opinion Services

KMS’s GST opinion services include the following:

Analysis and opinion on business functions

Opinion on the pricing of the products

GST opinion on industry-specific matters

Our GST experts provide their expert opinion on industry-specific issues including:

- GST on real estate

- GST on advertising sector, GST on media and entertainment industry

- GST on educational institutions and GST on NGO and charitable trusts,

- GST on gold and jewelry sector

- GST on transport agency and GST on cab services, GST on shipping industry, GST on logistics, GST on Automobiles industry

- GST on IT industry, GST on eCommerce websites, and GST on eCommerce marketplaces

- GST on hospitality industry, GST on food services, GST on restaurants

- GST on insurance and banking, GST on Banks and NBFC

- GST on coal, GST on Iron and Steel, GST on tobacco industry, GST on agriculture

- GST on pharma and life-saving drugs, GST on healthcare

- GST on fruits and vegetables, GST on Textiles

- GST on Wholesalers and Retailers, GST on small and medium enterprises, GST on freelancers

- GST on importers, GST on exporters, GST on special economic zone

GST opinion on miscellaneous matters

Our Approach:

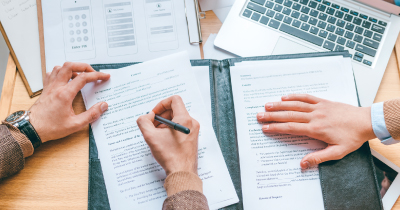

We understand the client's business, underlying circumstances, unique business challenges, GST provisions affecting the transaction, and document our findings.

We go through documents related to GST registration, payment of GST tax liability, monthly, quarterly, and annual GST returns, carry forward of credits, disclosure of outward supplies in returns, etc.

We understand the classification of supplies, GST rates, exemptions supplies, concessions applied, realization of related conditions for GST compliance, claiming of export benefits, etc.

We check compliance with reverse charge provisions, related payments made, availing the re-credit after payment, eligibility to obtain such credits, and any related documentation.

We verify GST input tax credits, eligibility to avail those, ineligibility, relevant documentation required for input tax credits, etc.

Based on the facts gathered, our GST consultants make the draft opinion ready. Our partners vet the same and finalize, and then the GST Opinion is issued to the client.

key features

KMS is selected as the one-stop solution for anything and everything related to GST because of the following reasons:

KMS believe in providing competent and independent GST guidance to our clients. We follow strict internal policies to keep our skill set updated to the highest standards for rendering high-quality GST opinion services.

OUR CLIENTS SAY

trust. transparency. professional expertise.

frequently asked questions(faqs)

Goods and Services Tax Network (GSTN) is a special purpose vehicle, which has been established to cater to the needs of GST. It enables access to a shared IT infrastructure and services to Central and State governments, taxpayers, and other stakeholders for the execution of GST.