GST Classification Services

Khandhar Mehta and Shah | GST Classification Services

GST CLASSIFICATION INTRODUCTION

The businesses in India must register for GST if their turnover exceeds the limit specified by the GST laws and comply with all the statutory requirements to avoid penalties and legalities.

GST Laws in India require GST classification of goods and services, and a unique code is attributed to each along with a unique rate of GST. GST Classification of goods and services helps in determining the correct rate of tax applicable to them.

The Harmonized System of Nomenclature (HSN) is followed to ensure compatibility with the global best practices. We understand it is difficult for companies to apply correct GST classification to goods and services. We, at KMS, come to your rescue with our GST classification services. Our GST experts and experienced professionals can support our clients with the precise GST classification so that the correct rate of GST can be applied, and the GST amount can be accurately calculated.

GST Classification Services

We support the companies in the classification of goods and services so that they can determine taxable and non-taxable items, classify items into goods and services, exempt items, and the correct rate of tax.

Identification of goods and services

Our first step in GST classification is identifying whether the nature of the item supplied is a good, service, or none of the two under the definitions provided under the CGST law of 2017.

Classification of activities, which can neither be classified as goods nor as services

Our strength lies in our knowledge of the GST classification of goods and services and the experience of dealing with such transactions. This strength allows us to classify even those activities, which are neither supply of goods nor supply of services.

Classification of composite and mixed supplies

There are some supplies, called mixed or composite supplies, which are difficult to understand and identify. Composite supply means a supply of two or more supplies of goods and/or services or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply. Mixed supply means two or more individual supplies of goods or services or any combination thereof, made in conjunction with each other for a single price where such supply does not constitute a composite supply. We provide the required guidance and advisory services for the classification of composite and mixed supplies, as these are difficult to understand and identify.

Allocation of HSN/SAC code in the software

Once the classification of goods and services is understood, KMS identifies the correct code from the HSN or SAC codes and allocates the same in the accounting software used by the client companies so that it can be used in the future for applying the right tariff and tax calculation purposes.

Being one of the well known CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

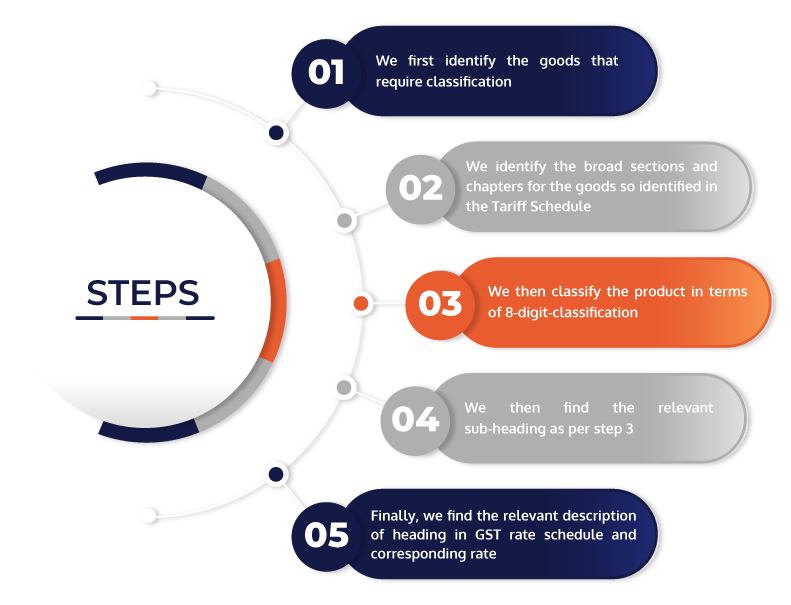

GST Classification of goods as per notification

The GST Council has issued Notification Number 01/2017-CT (Rate) dated 28.06.2017 prescribing the schedules for specified goods under CGST/IGST. We carry out the GST classification of goods as per the notification by observing the following steps:

ket features of kms

KMS ensure that we do the correct classification of goods and services under the new GST regime to ensure the correct applicable rate and correct calculation of tax liability so that clients do not face any legalities or notices from the department.

What do our clients say about us?

trust. transparency. professional expertise.

frequently asked questions(faqs)

Subscribe to KMS Newsletter