Concurrent Audit Services

Khandhar Mehta and Shah | Concurrent Audit

Concurrent Audit Services

The activities of mutual fund houses, financial institutions, and especially banks and their risk profiles are growing complex day by day.

What is a concurrent audit?

A concurrent audit or bank audit can be defined as a timely and systematic examination of the entity’s financial transactions to ensure accuracy, authenticity, and compliance with relevant regulatory requirements. Since the volume of transactions is very high, it is done on a regular basis. As concurrent auditing is contemporaneous with the transactions occurring, the process becomes a bit complex.

At KMS, we ensure effectiveness in our auditing process for which we reduce the time interval between auditing and its examination for speed of actions and efficient risk management.

Objectives of concurrent audit

On the one hand, where the objective of concurrent auditing is to ensure timely examination of the financial transactions; there are various other objectives as well which we keep in mind for carrying out concurrent audit such as:

Ensuring timeliness and accuracy in maintaining the company's or bank's books of accounts and periodical financial statements.

To improve the internal control system of the entity.

To improve transparency by implementing vouchers or evidence-based payments in the company or bank.

To ensure that the system, rules, regulations, policies, and procedures are followed properly by the company in line with the compliance requirements.

Being one of the well-known CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

Concurrent audit scope

Review of internal controls to check if they are adequate, considering the nature and size of the business and pinpointing areas requiring more stringent controls.

Verification of KYC, AML, TDS documents as per RBI and Ministry of Finance guidelines

Substantive checking of high-risk areas like credit, regulatory compliance, revenue, non-performing assets, and forex.

Bringing into the light any violation of rules, regulations, and procedures or any hidden fraud happening in the company.

Identifying inefficiencies at operational levels and detecting sources of leakage of income, if any.

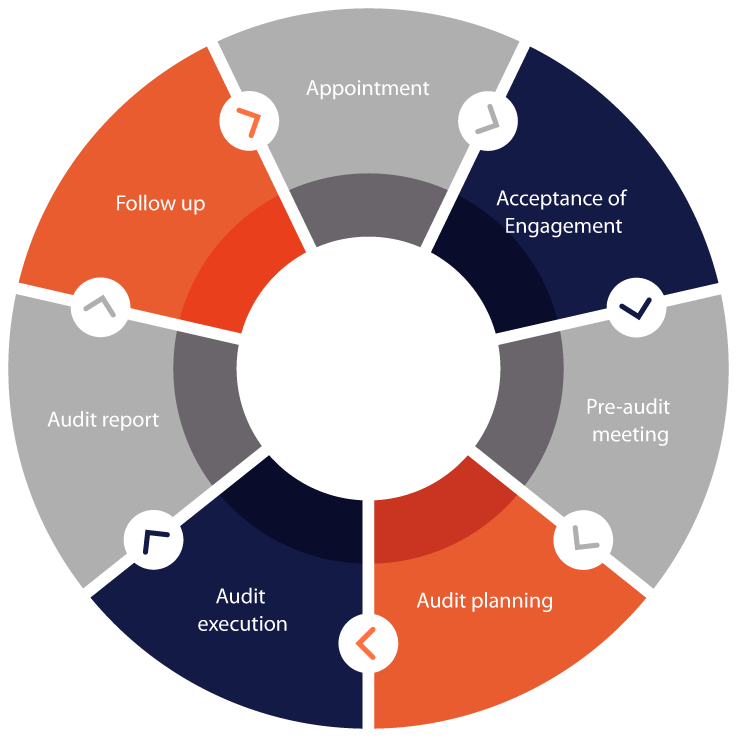

CONCURRENT AUDIT PROCESS

Benefits of concurrent auditing

Qualified professionals

Time saver

Better transparency

Differences between internal auditing and concurrent auditing

Internal auditing is conducted to upgrade the client's risk management practices and strategy. It enables management in strengthening internal controls and achieving operational efficiencies. Internal auditing also helps management in identifying, analyzing, and preventing errors and irregularities.

Concurrent auditing, on the other hand, is a systematic auditing process to ensure compliance, accuracy, and authenticity of the financial transactions. The main emphasis is on checking 100% transactions as they happen to detect irregularities immediately.

Why choose KMS for concurrent auditing?

KMS has decades of experience and a robust team of auditors who can help your bank with best-in-class bank audit services. The main mantra for our company is that client is the most important asset for us, and we would always keep their needs before anything and make sure we provide them with the services they deserve. We mainly depend on technology for carrying our services, and with the advanced technology in hand with the required skills and tools for bank auditing, we make the concurrent auditing process even faster.

WHAT OUR CLIENTS THINK OF US?

trust. transparency. professional expertise.