Formation of Company

Khandhar Mehta and Shah | Formation of Company in India

Introduction

Are you setting up a business?

Are you a foreign company intending to enter India? Do you want help in necessary registrations for your entity? Are you looking for some help in obtaining licenses and required permissions to start operations? If the answer is “Yes” to any of the above, you are at the right place – KMS. Our consultants help you in the entire process of the formation of company in India. Company Formation in India requires a legal registration, documentation, licenses, permissions, and initial banking requirements to be fulfilled. . We have answers to all your questions – we help you with company registration in India so that you can start operations without any hassle.

Company formation in India

Legal registration of a business is a prerequisite. The incorporation of companies in India is governed by the Companies Act 2013. Before registration, it is critical to choose the right type of legal structure.

One can select the appropriate legal structure from Private Limited Company, Limited Liability Partnership (LLP), One Person Company (OPC), and proprietorship. Deciding the structure of an entity requires an analysis of the goals and objectives, tax rates, expenses of compliances with various legalities, cost of registration, and many more. We help you choose the right structure depending on the above factors and provide you professional guidance in fulfilling all the requirements of company incorporation procedures in India.

Being one of the well established CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

Company Formation Services in India

KMS’s team of proactive and competent business setup professionals in India help the clients in all the aspects related to the formation of company in India:

Private Limited Company Registration in India

Minimum Requirements:

- Two directors and Shareholders

- There is no minimum capital required

- DIN and Digital Signatures for both the directors

- Proof of Registered Address

- Scanned copy of PAN Card and Aadhar Card/Voter ID/Passport/Driving License and latest passport size photograph of all directors

- Bank Statement/Utility bill in the name of the director as an address proof

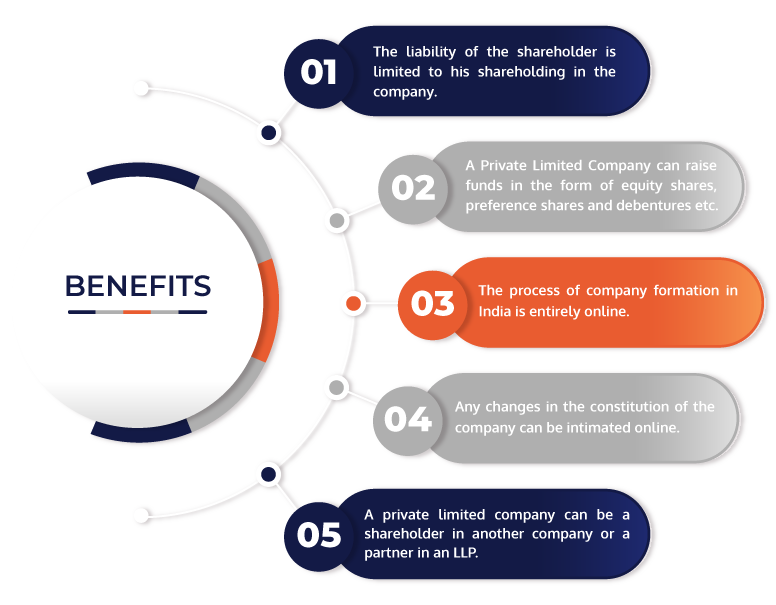

Benefits of incorporating a Private Limited Company in India

Registration of foreign companies

Foreign nationals find it suitable to incorporate a foreign subsidiary in India as FEMA guidelines do no allow foreign direct investment (FDI) in Proprietorship, Partnership, and One Person Company. For FDI in an LLP, RBI permission is required. As far as the formation of company in India is concerned, a foreign national has the following options to start a business in India:

A branch office is similar to a limited company, except that it cannot carry out manufacturing, retail trading, or processing. It acts as a branch office of a foreign company and earns income from the business operations as a domestic branch office does. It is required to pay the applicable taxes.

A project office is established for particular project purposes. It works as a temporary branch office in cases when an Indian company grants projects to the foreign company to be executed in India.

A liaison office is one, which functions as representing the foreign company in India. It acts as a channel of communication between the Indian company and the foreign entity’s foreign headquarters. It cannot carry out any operations or promotional activities in India. Since these businesses do not earn any income in India, their expenses are met through foreign exchange remittances from the head office.

A subsidiary company of a foreign company is called an Indian company, and it can have a full-fledged presence in the country.

Joint ventures are ones where the foreign entities do not have 100% ownership, but Indian entities hold a certain percentage in it.

Prerequisites to register a foreign company in India

- There is no minimum capital requirement for the formation of company in India

- There should be two directors, and one of them should be an Indian

- Shareholders can be anywhere in between 2-200, and all of them can be foreign nationals

- The company must have a local registered address in India

- It is required to appoint a statutory auditor within 30 days of the formation of company in India

I want to talk with expert >

Our Company Incorporation Services at a glance:

- Company registration

- Formation of Company in India under Startup India Scheme

- Application for Director Identification Number (DIN), Digital Signature Certificate (DSC) and name approval of the entity

- Preparation of Memorandum Of Understanding (MOA) and Articles of Association (AOA) and submission of SPICE, SPICE 33, SPICE 34

- ROC Compliances

- Government approvals

- Registration with the tax authorities for PAN, TAN, VAT,

- Compliance with FEMA and RBI Regulations. FDI approvals from RBI in case of foreign direct investment. Applying for and obtaining statutory certificates from RBI and FEMA

- Share transfer from residents to non-residents

- Applying for purchase/sale of shares, securities, and debentures

- Applying for repatriation of income/assets from and to India

- Setting up joint ventures and partnerships

- Registration for Import Export Code (IEC)

-

Registrations for provident fund, pension, ESIC, shops

and establishments, and others

- Assistance in opening a bank account

- Filing of TDS returns, Tax returns, VAT returns, and Professional Tax returns

-

Annual filing with ROC as to form AOC 4, Form 20B,

Form 66, Form 66, Form 23AC, Form 23ACA, Form 20B,

- Study of the market and insightful analysis

- Tax planning

- Statutory Audit, Internal Audit, Management Audit, IT Audit

- Other relevant registrations for employers, manufacturers, service providers, etc

Our strengths

KMS has been committed to providing excellent services to its clients always. Our clients put trust in us for company formation services because of the following reasons:

our client say

trust. transparency. professional expertise.

Thank you very much once again, and I will not hesitate to recommend your name to my business colleagues and friends for company formation services in India.

We could complete all the formation procedures smoothly and in time – all thanks to you. We are glad that we chose you as our partner to facilitate the company formation procedure. We look forward to continuing to work with you in the future.

frequently asked questions(faqs)

• Automatic route: Under Regulation 16 of FEMA 20 (R), foreign investment is possible in all sectors and activities without any approvals from the RBI or government

• Government route: The activities and sectors, for which automatic route of foreign investment is not available, need prior government approval

• Two alternative names for the proposed company, along with the justification for the same, where the naming convention must follow the rules and guidelines as prescribed by the Ministry of Corporate Affairs (MCA)

• Key objectives of the proposed company

• The authorized capital of the proposed company

• Names of other group companies

After receiving the application, MCA scrutinizes the application and checks if the proposed name is unique and does not match with the names of any existing companies. After thorough checking, it either accepts or rejects the application. MCA sends the approval or objection to the name to the applicant within a week through email.