Statutory Audit Services

Khandhar Mehta and Shah | Statutory Audit

statutory audit Services

Along with the globalization and ever-increasing regulatory requirements, companies need to be dynamic and transparent in the business to create a trustworthy image in the minds of stakeholders.

The financial statements of the company should provide the required clarity, quality, and create an environment of trust in the mind of readers. The statutory auditors at KMS possess a thorough knowledge of regulatory requirements, business challenges, and technical knowledge of local and international accounting and auditing standards to provide the top class statutory audit services in Ahmedabad. We believe in adding value by carrying out auditing in accordance with the regulatory requirements in a free and fair manner to bring transparency into the financial statements of the companies through our external audit services in Ahmedabad.

What is Statutory audit

Statutory audit, also known as external audit, is a type of audit that is mandated by a specific statute or law to make sure that the financial statements of the entities represent a true and fair view of its state of affairs and profitability. Statutory audit is governed by the Companies Act, 2013 and Companies (Audit and Auditors) Rules, 2014.

The scope of the statutory audit mainly depends upon the guidelines and regulations set by the government. The financial statements and the accounts of the organization are scrutinized to avoid discrepancies or any possible misrepresentation and ensure reliability.

Internal Audit and Statutory Audit

Statutory audit differs from internal audit in the sense that the statutory auditor is appointed by the stakeholders, whereas the internal auditor is appointed by the company management. The scope of the work in the statutory audit is decided by the law to check if the company’s financials represent a true and fair view. Internal audit, on the other hand, is done as per the scope decided by the management to improve operational efficiencies.Our team of statutory auditors at KMS are well-versed with the Indian Accounting Standards (Ind-AS) and International Financial Reporting Standards (IFRS) to carry out audits for local and international firms. We work in compliance with the regulations and set of rules as prescribed by the government, which makes our audit reports even more credible, precise, and reliable.

Being one of the well established CA firms in Ahmedabad, we always focus on giving our clients the best in class services that reflect our values and vision of transparency, flawless, and professional work. Visit our CA website to understand and know more about our services and our company. Choose us for your business as the best deserves the best.

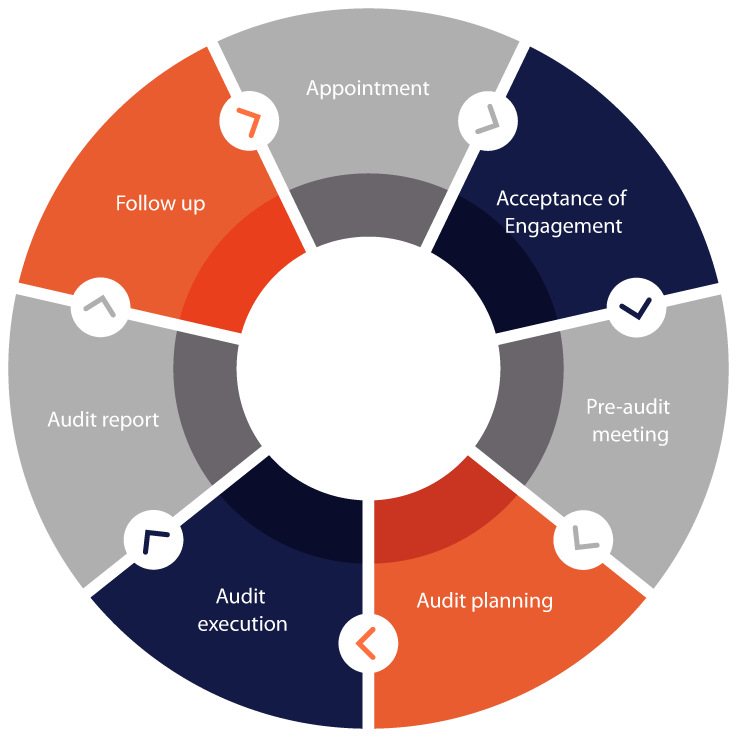

Statutory Audit Process

Our Statutory Audit Methodologies:

understanding the business of the entity and its environment

Appoinment

Acceptance of

engagement

Pre-audit meeting

Audit

planning

Audit

execution

Audit

report

Follow up

understanding of business cycles and business

Pre-audit

meeting

Audit

planning

Audit

execution

Audit

report

Acceptance of

engagement

Pre-audit

meeting

Audit

planning

identification of internal controls

Audit

execution

Audit

report

Acceptance of

engagement

Pre-audit

meeting

Audit

planning

Audit

execution

Audit

report

controls risk assessment

Acceptance of

execution

pre-audit

meeting

Audit

planning

Audit

execution

Audit

report

Acceptance of

engagement

pre-audit

meeting

detection risk assessment

Audit

planning

Audit

execution

Audit

report

Acceptance of engagement

Pre-audit

meeting

Audit

planning

Audit

execution

application of analytical audit procedures

Appoinment

Acceptance of

engagement

Pre-audit

meeting

Audit

planning

Audit

execution

Audit

report

Follow up

application of subtantive audit procedures

Pre-audit

meeting

Audit

planing

Audit

execution

Appoinment

Acceptance of

engagement

pre-audit

meeting

Audit

planning

issuance of audit report

Audit

execution

Audit

report

Accpetance of

engagement

pre-audit

meeting

Audit

planning

Audit

execution

Audit

report

We adopt a risk-based approach to address the core issues affecting your financials and business.

KMS has devised proprietary audit methodologies to obtain reasonable assurance that the financial statements are free from material misstatements. Our auditing methodologies enable us to obtain sufficient evidence to reduce the audit risk. We exercise professional skepticism during the course of the audit to draw meaningful conclusions. It helps us in knowing the materiality of the item and performing the critical evaluation of the audit evidence.

We customize the nature, timing, and extent of our audit procedures as per our professional judgement commensurate with the level of risk identified. During the course of the audit, we maintain our independence and encourage free communication. We believe that statutory audit in India is not merely a compliance exercise but also an opportunity to provide recommendations to our clients so that they can achieve higher efficiencies and their business goals.

We leverage technology to bring efficiency and effectiveness in our auditing. We use state-of-the-art audit tools and techniques to maintain audit working papers and files. We plan our audits utilizing the software to ensure that our best resources are deployed onsite. We continuously monitor our progress and take the necessary steps to meet the deadlines.

Our Strengths:

Our Statutory Auditors have a thorough knowledge of the subject and experience to deliver the best auditing services. They have knowledge of various industries and challenges within the businesses operating in those industries. We allocate audit resources as per the client profile and industry to make sure that the person who has a complete understanding of your industry carries out the audit. We keep them updated by investing heavily in their training and development. We organize a weekly meeting with our partners and auditors so as to exchange ideas and challenges and enhance our collective know-how.

Quality is our prime focus:

KMS believes in delivering nothing but the quality in everything that we do. Our audit professionals are trained on our quality standards and code of conduct. We have established processes and procedures to ensure the quality of work. This ensures that our audit work is of consistently high quality and in line with our quality standards. We also have a peer review system where partners and managers review the work to ensure that it complies with our policies and procedures.

We regularly seek feedback from our clients to ensure that their concerns are taken care of, and we provide audit services as per their expectations.

Benefits of a statutory audit

It enhances the credibility and authenticity of your financial statements because an independent statutory auditor does the audit.

While it confirms that the firm’s financials represent a true and fair view of its state of affairs and profitability, it also helps in assessing the areas prone to risk and losses.

The external audit helps in securing finance from financial institutions as it makes their financial statements more authentic and reliable.

External auditors also provide valuable insights that can help a business improve in several areas and achieve higher profitability and growth. It also helps in identifying and strengthening internal control deficiencies.

Key differences of kms

Few words from our clients

trust. transparency. professional expertise.